On Aug.13, the Russian government announced that, on Jan. 1, Ukrainian agricultural exports will be banned. Also on that list of banned agricultural products are the European Union, Norway, the U.S., Canada, Australia, Liechtenstein, Iceland, Albania and Montenegro.

The ban will expand the existing list of 13 Ukrainian-produced items already prohibitedsince last year.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

“As for Ukraine, a ban on agricultural produce will enter into force only in case thiscountry’s government applies the economic part of the association agreementwith the EU,” Russian Prime Minister Dmitry Medvedev said at a Cabinet of Ministers meeting on Aug.13, according to the Russian government website. “If we don’t reach an agreement with the mediation of the EU, and I don’t see any signs of this happening.”

A list of products to be banned from Jan. 1 as the economic part of Ukraine’s association agreement with the European Union comes in force.

Fruit,vegetables, nuts, meat products, raw and frozen meat, pork, poultry, live fish and seafood, milk

Source: The Russian Government

However,even if implemented, the ban wouldn’t change much in already tense bilateral trade relations, academic director of the Institute for Economic Research and Policy Consulting Veronika Movchan told the Kyiv Post.

Trade has already contracted by some 60 percent, to $5.2 billion in the first six months of 2015 compared to the same period a year ago.

However,Russia remains Ukraine’s single-largest trading partner as a nation. But that title is not likely to last long, given current trends and the war.

The Russian market has been steadliy losing its importance for Ukrainian exports,particularly in agriculture. Agricultural exports to Russia in first six months of 2014 accounted for eight percent of Ukrainian agricultural exports, while in the same period of 2015 it stayed at two percent only or $126 million.

“The strategic importance of the Russian market for Ukraine is a Soviet atavism,” Ukraine’s Agriculture Minister Oleksiy Pavlenko said as reported by the ministry’s press office. “Due to unpredictability, artificial barriers, milk and meat trade wars, blockade of our confectionry, Ukrainian producers have started to aim at European, Asian, African and American markets. Successful diversification allowed to compensate the loss of profit from exports to Russia to a large extent.”

As an example, Israel has recently opened its market for Ukrainian eggs after the inspection results appeared positive for two Ukrainian producers.

Acording to Movchan, diversification is the guarantee of stability, and Ukraine is moving in that direction. It’s unreasonable to count on immediate change of Russia’s status of key trade partner after decades of common history and interrelated economies. But reorientation of Ukraine’s economy has been happening since its independence, although unevenly but steadily.

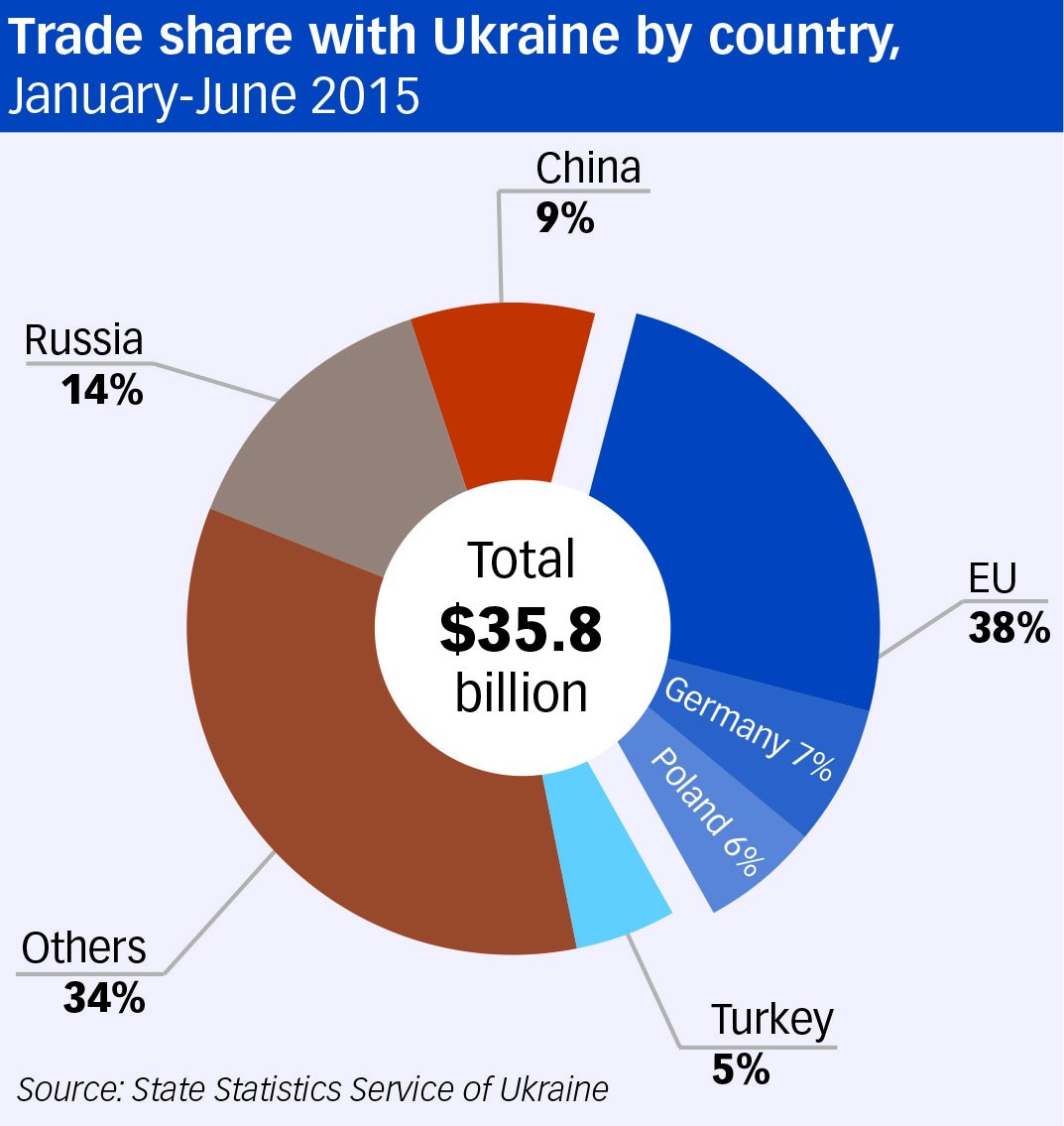

In 90’s Russia accounted for 50 percent of Ukraine’s external trade, in 2015 it’s only 14 percent of $35.8 billion turnover.

The move from Russia as the key Ukrainian trade partner will take some time but Russia is doing everything possible to speed up this process,” Movchan said.

Apart from that, experts agree that the EU should be referred to as a single market being the single custom zone and in this case it by far exceeds Russia in trading with Ukraine, accounting for 38 percent of Ukraine’s external trade turnover in first half of 2015.

Kyiv Post staff writer Olena Gordiienko

can be reached at gordiienko@kyivpost.com

You can also highlight the text and press Ctrl + Enter