The introduction of mobile number portability, a service allowing users to change mobile operators and retain their phone number, was meant to help escape “mobile slavery” and to level the playing field in the telecom industry.

Up to five million Ukrainians wanted to change their carriers, potentially reshaping the entire industry in the country, according to forecasts the state regulator, Radio Frequencies Center, made back in 2017.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

It took Ukraine nine years of tenders, court hearings and a $1.6-million investment from the telecom regulator alone — none of the operators discloses the sums it invested — to introduce the service.

However a year after its rollout in May 2019, results have fallen short: Only 50,000 of 54 million mobile users have transferred to another network.

It appears that the market has moved on. As Ukraine rolls out the complicated and expensive procedure, a general shift toward data applications rather than traditional mobile use has deterred customers from moving networks.

Complex procedure

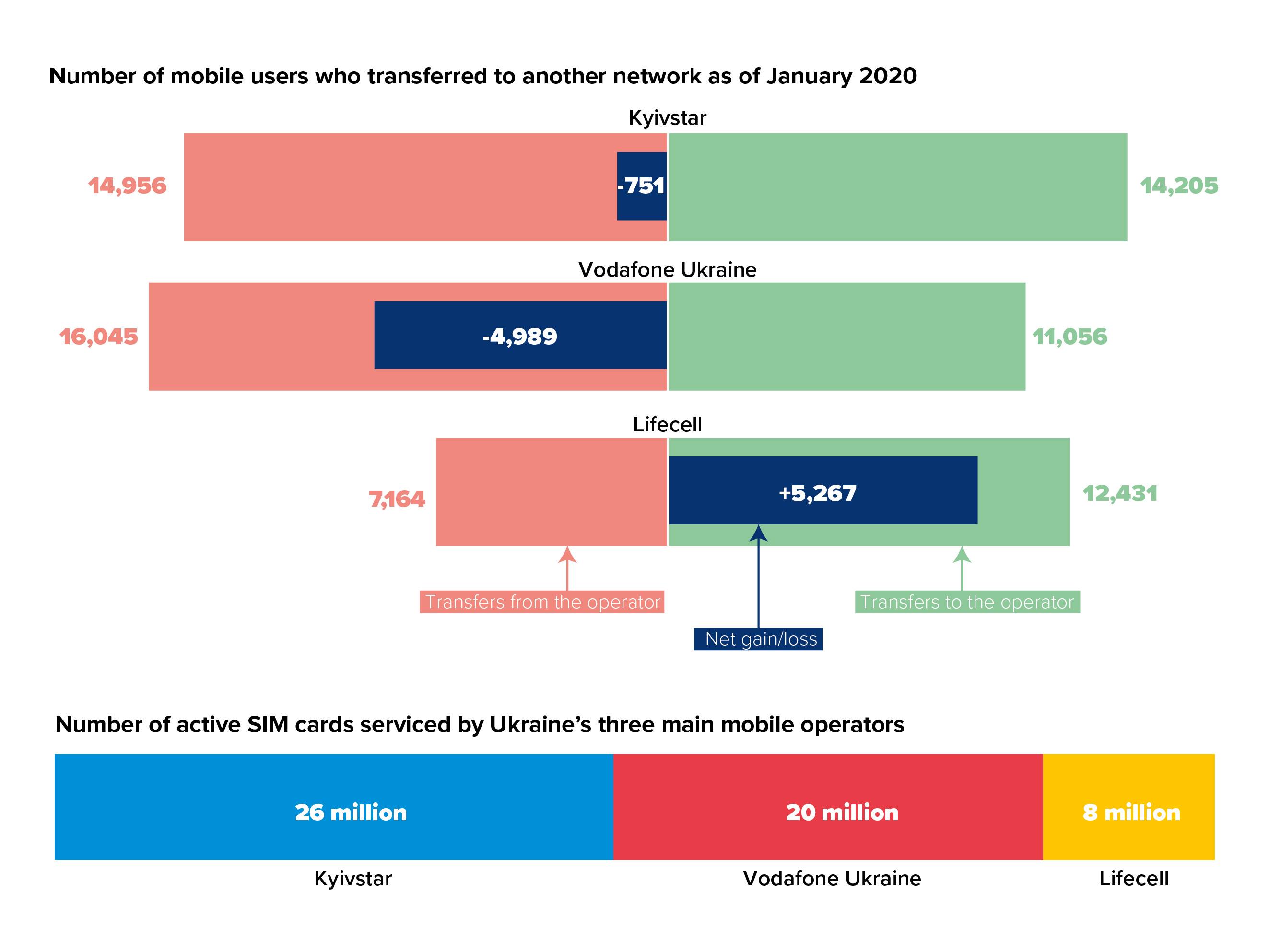

Only three operators control the telecom market in Ukraine — the largest, Russian-owned Kyivstar, with 26 million active users; the runner-up, Azerbaijani-owned Vodafone Ukraine, with 20 million; and the smallest, Turkish-owned lifecell, with roughly 8 million users.

Out of the three carriers, lifecell benefits the most from number portability. The results, however, are modest: So far, the carrier has gained 5,267 new users, while the subscriber base of Kyivstar and Vodafone declined by 751 and 4,989 respectively.

“Our expenses were estimated in millions of hryvnias, yet the numbers of transfers are counted in thousands,” Vodafone Ukraine spokesperson Victoria Pavlovska told the Kyiv Post.

Lifecell, in turn, believes the results are so dismal because the procedure is too complex and time-consuming.

“Since its launch, the service has not conformed to current market conditions and successful worldwide cases,” Natalia Davydenko, head of regulatory affairs and strategy at lifecell, told the Kyiv Post.

Anywhere in the world, except for India and the United Kingdom, subscribers can directly call the mobile carrier to which they want to switch. The system works in Ukraine too, but there is one prerequisite: the number has to be registered, legally connected to a person.

This is troublesome, as 95% of mobile phone subscribers in Ukraine use pre-paid SIM cards, which can easily be bought from vendors on the streets. These mobile users haven’t shown their passport and proved their identity when buying a SIM card.

As a result, they must fill out an online form or go to a physical branch of their current provider, hand over their passport details and only then can they call a new carrier and ask to switch networks.

But even when a person submits documents, the process takes three more working days to finish. Meanwhile, in the Czech Republic and some other European countries, it takes only a few minutes.

According to lifecell, it’s unreasonably long. The carrier believes its competitors use the overly complicated procedure as an “excuse” to reject number transfers in as much as 60% cases. Both Kyivstar and Vodafone Ukraine publicly deny this.

In December 2019, the state regulator presented a draft law offering changes to the current procedure which imply that customers can inquire with their operator directly to transfer them to another carrier. And the procedure will take only one working day. It’s unknown, however, when the amendments will come into effect.

Long overdue service

Ukraine became one of the last countries in Europe to provide number portability to its telecom customers.

Changes to the existing telecoms law had been high on the agenda since parliament passed the relevant bill in 2010, but polarized views on how to implement it delayed the launch for almost nine years.

The tender for providing the service had to be held multiple times, as the firms that lost would go to court to undermine the decision. As a result, the rights to implement number portability were passed from one company to another.

Finally, the Kyiv-based SI Center won the contract in April 2016 with a bid of Hr 39.5 million ($1.47 million) against the Hr 71 million ($2.63 million) offered by rival company Dialink. But even this time, the company was only allowed to start working on the service one year after the tender results, in 2017.

As a decade passed discussing the rollout of MNP in Ukraine, technology brought changes to the Ukrainian telecom market, switching the focus onto the mobile internet, rather than voice communication or even text messages, once the major revenue sources.

In the past, it was expensive to call from one operator to another, and the inability to switch providers used to force Ukrainians to keep at least two active SIM cards — for friends, for work, and for family calls. Now inter-network calls are frequently done online via messengers like Viber, WhatsApp and Telegram.

So it’s data today — not the cellular network — that is bringing most of the revenue to mobile operators, according to their latest financial reports.

“Mobile number portability was in demand when the market was expanding,” independent telecoms expert Roman Khimich told the Kyiv Post. “Now three main operators — Kyivstar, Vodafone Ukraine and lifecell — offer almost the same prices, and subscribers have no motivation to transfer their numbers.”

New trends in the telecom market mean that the popularity of mobile number portability services is not expected to increase soon. The great migration of subscribers has never happened, but according to Bogdana Piven, deputy head of the state telecom regulator, the mobile number portability service is about more than popularity. It also helps the market to be a little bit fairer.

“It is a civilized, publicly accessible service that characterizes an open market,” Piven said.

You can also highlight the text and press Ctrl + Enter