Last time, I noted that the Urals oil price had breached the $60 / barrel price cap, and moreover, that the Urals discount was shrinking. The situation has deteriorated further over the last week.

JOIN US ON TELEGRAM

Follow our coverage of the war on the @Kyivpost_official.

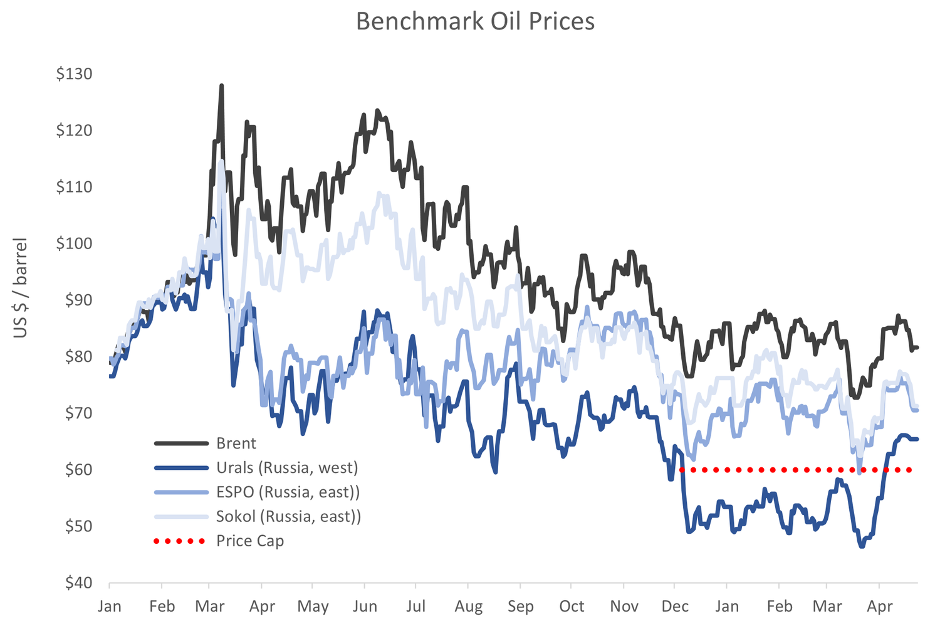

Let's start with oil prices. Brent eased back a bit this week to the range it has been holding for most of the year. On Friday, it closed at $81.66. Not much news here, save that OPEC's production cuts have not produced visible results to date.

On the other hand, the Urals oil price, the price Russia receives for its crude oil exports to the country’s west, has settled in the mid-$60s, latest at $65.44 / barrel. This is well above the $60 / barrel price cap dictated by the western powers. Thus, Russia has not only broken through the cap limit, but also sustained the Urals price above the cap level.

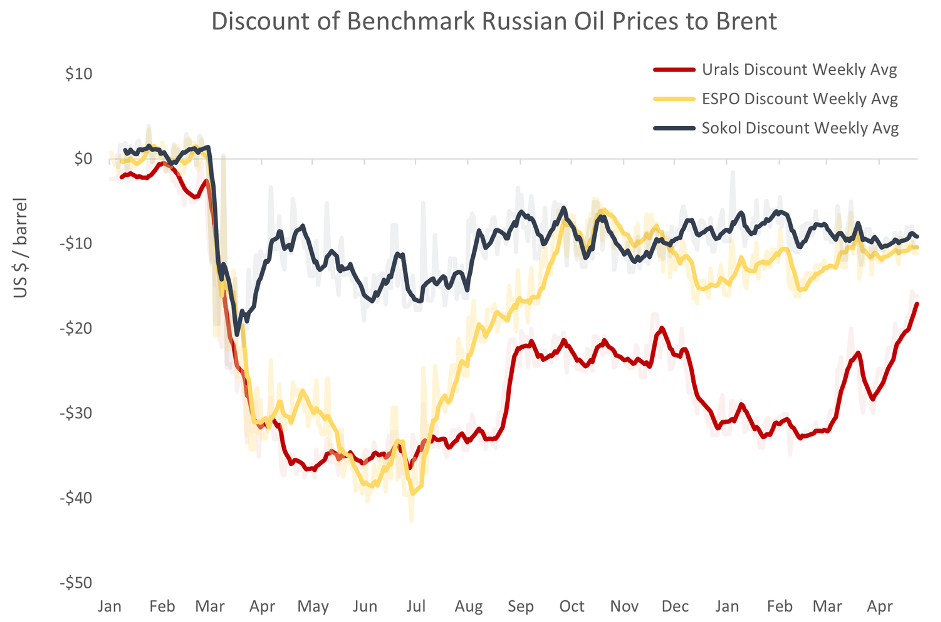

The news on the Urals discount is substantially worse. As readers will recall, the Urals discount is the difference between the Brent oil price, the benchmark for Europe; and the Urals price, the benchmark for Russian western crude exports. This discount is closing with screaming speed, now only $16 / barrel, the smallest since the start of the war. The Oil Price Cap is not only failing, it is failing spectacularly.

Meanwhile, efforts are beginning to try to salvage the program. The Poles want stricter enforcement of the Price Cap, and Bloomberg reports that a tanker company, Gatik Ship Management, had "lost industry standard insurance for its fleet after falling foul of a Group of Seven price cap". Gatik is a shadowy company with nominal headquarters in Mumbai, India.

Putin Vows ‘Destruction’ on Ukraine After Kazan Drone Attack

Bloomberg elaborates: Gatik is one of a handful of tanker companies that sprang up out of nowhere when the west began ratcheting up sanctions on Moscow last year.

When Bloomberg visited the address earlier this year, a person from a neighboring office said Gatik had moved out and there was mail strewn on the floor outside. There is no website, phone number, or other means of contacting the firm.

The company operates a fleet of 48 Aframax tankers, the type used for Russia crude exports.

So what happens next? Well, it is reasonably safe to assume that Gatik's vessels will be sold or otherwise transferred to a new, similarly shadowy company, which we may call Gatique (no relation!) with headquarters, say, two blocks from Gatik. This new company will obtain maritime insurance, and after a few months will be deemed in violation of the Price Cap, after which the vessels will be sold to a company which we may call Batik, and so on.

Prohibitions, price caps and resulting black markets inevitably devolve into games of Whac-A-Mole (here, for my Ukrainian readers). The only surprise is the unending naivete of the US Treasury, which, again according to Bloomberg, "warned that some oil tankers shipping Russian crude in Asia are using deceptive tactics to evade the Washington-led price cap on the country’s exports." Goodness, who knew?

If you were a Ukrainian policy-maker, you might assume that the system should be self-correcting, that the US government would eventually modify the Price Cap incorporating black market theory. Not at all. The history of prohibitions shows only two government responses, either tacit acceptance of black markets or doubling down on enforcement. Neither produces good results, and both represent a material threat to Ukraine, particularly in the post-war world.

If the Ukrainians fail to ask for a change, the current Oil Price Cap will continue in some form indefinitely, an on-going game of Whac-a-Mole, sometimes bringing a rush of enforcement and, at others, feigned ignorance and tacit acceptance of Russian oil smuggling. Both approaches will fail, just as the current Price Cap is failing.

All this is likely to continue until the Ukrainians stand up and request a better system. Unfortunately, the Ukrainians are mired in passivity. The Ukrainian Embassy in DC has had our exposition on the topic for an entire year now, and they have done exactly nothing with it. The sooner the Ukrainians wake up and take responsibility for the success of Russian oil sanctions, the sooner the matter will be addressed to Kyiv’s satisfaction.

Reprinted with the authors permission, you can read the original article here.

The views expressed in this opinion article are the author’s and not necessarily those of Kyiv Post.

You can also highlight the text and press Ctrl + Enter